Wall Street opened May with gains as strong results from Microsoft and Meta revived enthusiasm for artificial intelligence, lifting major indexes despite mounting economic concerns. The Nasdaq led the rally, fully erasing its April losses, while the S&P 500 climbed back near pre-tariff levels. Information technology outperformed sharply, helping offset fresh signs of weakness in the economy. Weekly jobless claims unexpectedly surged to their highest since February 2022, and US manufacturing contracted further in April. Globally, trading volumes were thinner with many European and Asian markets closed for the Labour Day holiday. All eyes now turn to Friday’s US payrolls report for further direction.

Key Takeaways:

- Dow Edges Higher in Cautious Trade: The Dow Jones Industrial Average rose 83.60 points, or 0.21%, to close at 40,752.96. Gains were led by strength in Microsoft, though macroeconomic worries, including weak jobless data, capped broader upside for blue-chip stocks.

- S&P 500 Climbs Near Pre-Tariff Levels: The S&P 500 advanced 0.63% to end at 5,604.14, reclaiming ground lost since early April’s tariff announcement. Tech outperformed, with the information technology sector rising more than 2%.

- Nasdaq Recovers Entire April Decline: The Nasdaq Composite surged 1.52% to close at 17,710.74, fully reversing its losses since April 2. The move was driven by optimism around artificial intelligence after upbeat results from Meta and Microsoft reassured investors about tech sector resilience.

- UK Lifts Europe as Most Markets Shut for Holiday: With Germany, France, Italy, and Spain closed for the May Day holiday, the FTSE 100 edged up 0.02% to extend its winning streak to 13 sessions, matching its best run since 2017. UK movers included Novo Nordisk, which rose 2% on stronger US access to Wegovy, and Rolls-Royce, up 1.8% after reaffirming 2025 guidance. Lloyds and LSEG both fell 2.3% after earnings. Britain’s manufacturing PMI improved slightly but remained in contraction at 45.4, and mortgage borrowing jumped £12.96 billion in March, the largest rise since June 2021, as buyers rushed to beat expiring tax breaks. Meanwhile, Tesla sales dropped sharply across parts of Europe, falling 43.9% year-to-date in France and 67.2% in Denmark last month, underscoring the EV maker’s ongoing regional struggles amid growing Chinese competition and political backlash.

- Asia Rises in Light Trading as BOJ Holds Rates Steady: Japan’s Nikkei 225 climbed 1.13% and Australia’s ASX 200 rose 0.24% amid thin regional trade with China, Hong Kong, India, and South Korea closed for Labour Day. The Bank of Japan kept interest rates steady, while yields on 10-year JGBs fell. In Australia, the trade surplus widened sharply to AUD 6.9 billion in March, boosted by strong iron ore and gold exports. The day also marked the ASX 200’s fifth straight session of gains, ahead of Saturday’s national election.

- Oil Rebounds on Iran Sanctions and Tech-Led Risk Appetite: US crude settled at $59.24, up $1.03 or 1.77%, while Brent rose $1.07 to $62.13. The rebound followed new US sanctions on Iran, with President Trump announcing penalties on buyers of Iranian oil and petrochemicals. However, looming OPEC+ output discussions and Saudi Arabia’s stance against supply cuts kept the outlook uncertain.

- Yields Rise Even as Data Disappoints: Treasury yields moved higher despite soft economic data, with the 10-year yield up to 4.212% and the 2-year climbing to 3.697%. Markets brushed off signs of economic cooling as traders focused on Friday’s nonfarm payrolls report and the Fed’s next move. Fed rate cut expectations remain cantered on June, though immediate easing is seen as unlikely.

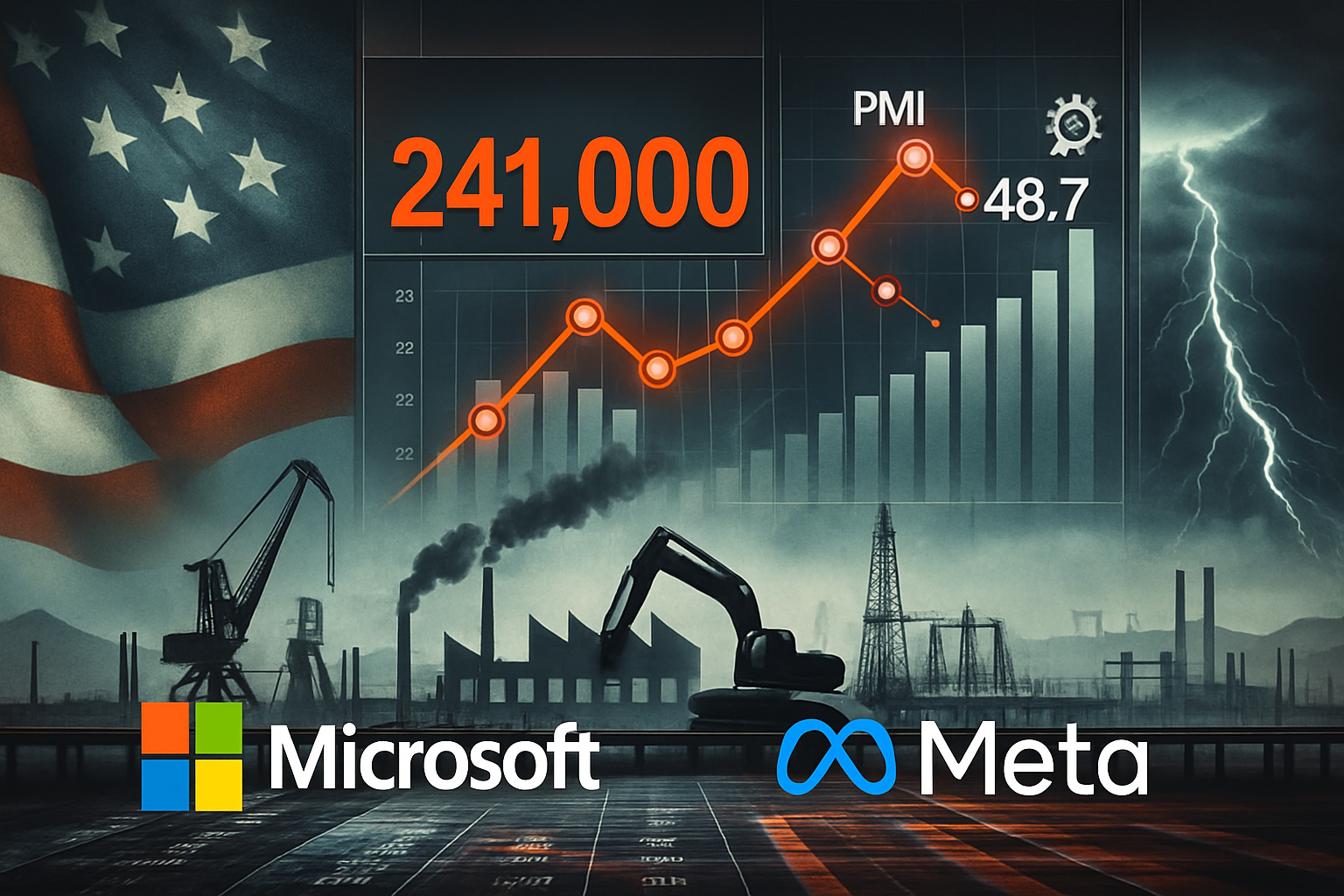

- Jobless Claims and Factory Activity Point to Cooling Economy: Weekly initial jobless claims jumped to 241,000, well above expectations and the highest since February 2022. Continuing claims also rose sharply to 1.92 million. Meanwhile, the ISM Manufacturing PMI slipped to 48.7 in April, signalling deeper contraction as supply chain pressures and weak new orders persisted. Together, the data suggest growing cracks in the labour and industrial sectors.

FX Today:

- EUR/USD Slips into Deeper Consolidation Phase: EUR/USD dropped 0.36% to close at 1.1287, marking its third consecutive daily loss and extending the retreat from its mid-April high above 1.1600. Although the pair remains comfortably above the 50-day (1.0957), 100-day (1.0675), and 200-day (1.0778) SMAs—each still sloping upward—bullish momentum has clearly faded. Support at 1.1250 is being tested and a break below this level could open the path to 1.1150 and potentially 1.1100, fully retracing the late March rally. On the upside, bulls must first reclaim 1.1350 to regain control, with stronger resistance near 1.1500. Recent candles show contracting real bodies and growing upper wicks, signalling hesitation and a shift toward profit-taking.

- GBP/USD Extends Pullback but Trend Remains Structurally Bullish: GBP/USD fell 0.36% on Thursday to settle at 1.3283, extending its losing streak to five sessions. While the short-term tone has weakened, the broader structure remains constructive. The pair is still well supported by the rising 50-day SMA at 1.2993, and the 100- and 200-day SMAs below offer further cushion at 1.2729 and 1.2846 respectively. The current retreat has brought price into the 1.3260–1.3300 consolidation zone, which may serve as a base for another leg higher if defended. Resistance is overhead at 1.3350 and 1.3450, with a breakout above the latter likely to reignite the rally. Failure to hold above 1.3200 would begin to erode the bullish bias.

- USD/JPY Explodes Higher, Tests Critical Resistance Zone: USD/JPY soared 1.77% to end at 145.59, logging one of its strongest daily gains in recent months. The breakout above the 144.00 ceiling decisively ends the choppy consolidation phase that began in early April. Price is now just below the 50-day SMA at 146.95, a key resistance level that could determine whether this rally evolves into a full trend reversal. If broken, upside targets emerge at 147.50 and 149.00, where the 200-day SMA at 149.83 also sits. If momentum falters, support lies at 144.00 and then 142.50 on a retest of the prior breakout zone.

- NZD/JPY Surges to Two-Month High as Momentum Builds: NZD/JPY closed Thursday at 86.01, up 1.45%, notching its highest close since early March. The pair has now clearly broken above the descending channel that contained most of this year’s price action. Thursday’s gain brought it above the 100-day SMA at 86.25 and just shy of the 200-day SMA at 88.03. A close above 88.00 would likely confirm a medium-term trend reversal and open a path toward 89.50. Near-term support lies at 84.50, followed by 83.00, which aligns with the late-March breakout zone.

- Gold Breaks Down as Bears Regain Short-Term Control: Gold dropped $61, or 1.87%, to close at $3,226.93, posting its fourth consecutive daily decline and confirming a breakdown below the $3,300–$3,330 consolidation zone. The metal reached a low of $3,202.03 intraday and is now flirting with key psychological support at $3,200. A breach of this level could accelerate the correction toward the 50-day SMA at $3,080.30. Further support lies at the 100-day and 200-day SMAs, currently at $2,906.56 and $2,747.46 respectively. The steep decline has been accompanied by large-bodied red candles and shallow wicks, signalling aggressive selling pressure. For the bullish trend to resume, gold must first stabilise and reclaim $3,300.

Market Movers:

- Microsoft Soars on Strong AI-Led Earnings Beat: Microsoft (MSFT) closed up more than 7% after reporting fiscal Q3 revenue of $70.07 billion, well above the $68.48 billion consensus.

- Meta Rallies After Confident Outlook Amid Uncertainty: Meta Platforms (META) rose more than 5% after posting Q1 sales of $42.3 billion, topping expectations of $41.4 billion.

- CVS Health Rises on Earnings Surprise and Guidance Boost: CVS Health (CVS) rose more than 4% after reporting Q1 adjusted EPS of $2.25, well above the $1.69 consensus.

- Wayfair Gains on Better-Than-Expected Revenue: Wayfair (W) closed up more than 4% after announcing Q1 net revenue of $2.73 billion, slightly ahead of the $2.71 billion consensus.

- Beckton Dickinson Tumbles on Forecast Cut: Beckton Dickinson & Co (BDX) dropped over 18%, the worst performer in the S&P 500, after slashing its full-year adjusted EPS forecast to $14.06–$14.34, down from a prior range of $14.30–$14.60 and below the $14.43 consensus.

- Qualcomm Falls After Weak Revenue Outlook: Qualcomm (QCOM) sank more than 8%, leading losses in the Nasdaq 100, after projecting Q3 revenue between $9.9 billion and $10.7 billion.

- Eli Lilly Drops Despite Strong Demand for Mounjaro: Eli Lilly (LLY) fell more than 11% after cutting its full-year adjusted EPS guidance to $20.78–$22.28, down from a previous estimate of $22.50–$24.00.

- Confluent Sinks on Disappointing Subscription Forecast: Confluent (CFLT) plummeted over 19% after issuing weak Q2 subscription revenue guidance of $267–$268 million, missing analysts’ expectations of $269 million and raising questions about growth sustainability.

Markets kicked off May with a renewed sense of optimism, driven by standout earnings from Microsoft and Meta that revitalised enthusiasm around artificial intelligence. While gains in the major indexes were broad-based, the sharp outperformance of tech helped the Nasdaq erase April’s losses entirely. However, beneath the surface, economic signals remained concerning, jobless claims surged, manufacturing contracted further, and bond yields rose ahead of Friday’s pivotal payrolls report. With most global markets just returning from holiday closures, the next trading session could set the tone as investors weigh resilient corporate earnings against growing signs of economic strain.